Position size is usually the easiest one to keep your maximum loss risked per trade in control and, at times, is the only one. Your forex position size is how many forex lots (micro, mini or standard) you take on a trade. Your risk is broken down into two parts--trade risk and account risk.

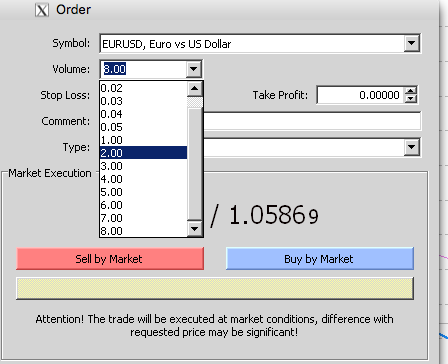

Thus, when you open a trade with a 0.10 lot, you will trade 1 mini lot. It is a great choice for those forex traders who may want to trade with a lower, or perhaps no leverage at all. A micro lot is 1% of a standard lot (100 000 x 0.01) = 1 000 units of a base currency. Therefore, when you open a trade with a 0.01 lot, you will trade.

- One carton includes 12 eggs. The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units. Some brokers show quantity in 'lots', while other brokers show the actual currency units.

- Before we jump onto the screen, lets break down lot size in more detail. There are a wide variety of lot sizes you can take for a Forex trading position. Forex Trading Lot Sizes. 1.0 Standard lot = 100,000 of base currency – £10 per pip.10 Mini lot = 10,000 of base currency – £1 per pip.01 Micro lot = 1,000 of base currency – £.10 per pip.

- A Standard LOT in Forex Trading equals to 100.000 units of any given currency. For example, 1 Standard LOT of EUR/USD equals to €100.000. Other lot sizes commonly used are: Mini LOT (also referred as 0.1 lot) - 10.000 units of any given currency.

- What is the standard lot size in forex? The standard forex size lot is 100,000 units of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are 500 000 currency units.

What is a Forex Lot and why does it matter

Obsessive focus on risk and money management, meaning keeping your risk per trade as low as possible or avoiding relatively large losses, however you phrase it, is what separates the elite long-term survivors from the majority that eventually drop out. The size of your forex positions is a key part of risk management because the smaller the lots you trade, all else being equal (leverage, number of lots, and more), the less each pip is worth.

So, smaller forex lots mean that for each percentage move in price, there's less profit, but more importantly, less loss. It's the losses that can wipe out your capital, your confidence, and thus your trading career. For a number of reasons based on the history of forex trading, currency pairs usually trade in standard size lots of 100,000 units of the base currency (1 forex lot). To make trading affordable to the individual trader of average means, online forex brokers invented mini accounts with lot sizes of 10,000 (1 forex mini lot), and micro-accounts with lot sizes of only 1,000 units (1 forex micro lot). We don't just like these newfangled innovations. We love them. Because smaller forex lot sizes reduce your risk per lot traded, they give you a number of important advantages over standard lots.

They provide greater flexibility to adjust your forex position sizes with the circumstances:

- When you're hot, you can increase position size by adding forex lots.

- While you're learning, making the transition from forex demo accounts to real accounts, or in a losing streak, small lots help you keep losses down until your trading improves and is consistently profitable most weeks or months.

- When you want to enter or exit a position in stages with only part of your planned position (another risk management technique), smaller lots make that easier to do while keeping the total cash risked within 1 to 3 percent of your capital.

Here's how all these elements fit together to give you the ideal forex position size, no matter what the market conditions are, what the trade setup is, or what forex strategy you're using.

Continue reading for more information or start demo trading and notice in real-time how the forex lot size influences your profit and loss. Learn how to master position size in forex trading with our online MasterClass.

01 - Set Your Account Risk Limit per Trade

This is the most important step for determining forex lot size. Set a percentage or dollar risk limit, you'll risk on each trade. Most professional traders risk 1 to 3 percent of their account. For example, if you have a $10,000 trading account, you could risk $100 per trade if you risk 1% of your account on the trade. If your risk 2%, then you can risk $200. You can also use a fixed dollar amount, but ideally, this should be below 2% of your account. For example, you risk $150 per trade. As long as your account balance is above $7,500, then you'll be risking 2% or less. While other variables of trade may change, account risk is kept constant. Choose how much you're willing to risk on every trade, and then stick to it. Don't risk 5% on one trade, 1% on the next, and then 3% on another. If you choose 2% as your account risk limit per trade, then every trade should risk about 2%.

02 - Determine Pip Risk on Trade

You know what your maximum account risk is on each trade, now turn your attention to the trade in front of you.

Pip risk on each trade is determined by the difference between the entry point and where you place your stop loss order. The stop-loss closes out the trade if it loses a certain amount of money. This is how risk on each trade is controlled, to keep it within the account risk limit discussed above.

Each trade varies though, based on volatility or strategy. Sometimes a trade may have five pips of risk, and another trade may have 15 pips of risks. When you make a trade, consider both your entry point and your stop loss location. You want your stop loss as close to your entry point as possible, but not so close that the trade is stopped out before the move you're expecting occurs.

Once you know how far away your entry point is from your stop loss, in pips, you can calculate your ideal forex lot size for that trade.

03 - Determine the Forex Position Size

Ideal forex position size is a simple mathematical formula equal to:

Meaning Of Lots In Forex

- Pips at Risk X Pip Value X Lots traded = $ at Risk

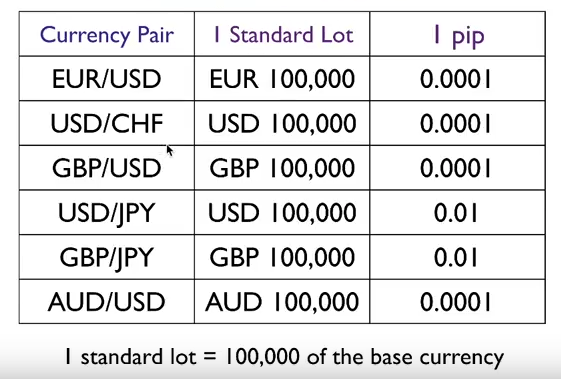

We already know the $ at Risk figure, because this is the maximum we can risk on any trade (step 1). We also know the Pips at Risk (step 2). We also know the Pip Value of each currency pair (or you can look it up).

All that leaves us to figure out is the Lots traded, which is our position size. Assume you have a $5,000 account and risk 2% of your account on each trade. You can risk up to $100, and see a trade in the EUR/USD where you want to buy at 1.3040 and place a stop loss at 1.2990. This results in 50 pips of risk.

If you trade mini lots, then each pip movement is worth $1. Therefore, taking 1 forex mini lot position will result in a risk of $50. But you can risk $100, so you can take a position of 2 mini lots. If you lose 50 pips on a 2 forex mini lot position, you'll have lost $100. This is your exact account risk tolerance; therefore the position size is precisely calibrated to your forex account size and the specifications of the trade. You can plug in any numbers into the formula to get your ideal position size (in lots). The number of lots the formula produces is linked to the pip value inputted into the formula.

source: Forex Trading MasterClass

Final Words

Proper forex position sizing is key. Establish a set percentage you'll risk each trade; 1 to 3 percent is recommended. Then note your pip risk on each trade. Based on account risk and pip risk you can determine your position size in forex lots.

The smaller the forex lot size, the lower the risk because we reduce the following:

- The value of each forex pip.

- The cost of each 1 percent moves against you.

The potential loss if your stop-loss order is hit. We measure risk not by the total position size but by the potential loss if your stop order is hit.

Yes, smaller position sizes mean lower profits when prices move in your favor, with lower interest income from carry-trading. However, the priority is to keep losses low. Always. As a given percent loss requires a larger percent gain to recover your loss because you're trading from a reduced capital base. Once you find the right combination of trading styles, instruments, and technical analysis that suits you, you will have time to increase lot size, risk, and profit potential. Until you're consistently profitable over many months (regardless of your percentage of winning trades), the priority is to keep risk and losses on any given trade to within 1– to 3 percent of your account size. Profiting with only a minority of winning trades is okay, because many profitable traders succeed that way, as discussed in the Forex Trading MasterClass.

Understanding what is 1 forex lot size is important, but if you want some help, MetaTrader 5 AM Broker offers a useful Forex Lot Size Calculator. Start trading and notice how 1 forex lot influence your profit and loss.

Source:

Standard Lot Definition - https://www.investopedia.com/terms/s/standard-lot.asp

Round Turn (Finance) - https://www.nfa.futures.org/faqs/members/nfa-assessment-fees.html

How to Determine Position Size When Forex Trading - https://www.thebalance.com/how-to-determine-proper-position-size-when-forex-trading-1031023

In Forex trading, lot is used to describe the amount a Forex trader is actually trading at any given time – In simpler terms, lot refers to the size of the trade.

To be able to understand what lot is in Forex trading, we need to take a step back in history. A few decades ago, Forex brokers used to offer one contract size only i.e. 100,000 units of currency. Over the years, technological advancements and lower transaction costs made it easier for Forex brokers to offer lower contract sizes hence the birth of smaller lot sizes such as mini lots and micro lots which refer to contract sizes of 10,000 and 1,000 units of currency respectively.

3 Types of Lot Sizes in Forex Trading

There are three main types of lot sizes in the Forex market – The standard lot, mini lot and micro lot. Below is a brief discussion of each of these lot types:

Micro Lot Size in Forex Trading

As the name suggests, a micro lot is equivalent to 1/100th of a standard lot i.e. 1/100 x 100,000 units = 1,000 units of currency or simply, 1,000 units of the base currency which is the 1st currency in any currency pair.

For instance, if you have a currency pair such as the EUR/USD, the base currency is the EUR i.e. the currency you are buying. The other currency (the USD in our case) is the quote currency i.e. the currency you are selling. The price displayed is usually the quote currency. If for instance the EUR/USD is quoted as 1.1400, to buy 1 EUR, you need to pay $1.14.

In our case, you will be trading with 1,000 EUROS if you are trading the EUR/USD with one micro lot. Although it is possible to trade with a smaller lot known as the nano lot which is simply 100 units of the base currency, most Forex brokers allow micro lot trades and above.

Micro lot trades allow new traders to participate in the market without having to start with a lot of capital. A micro lot will also reduce the overall exposure of a new trader allowing them to learn trading with little risk.

When trading with one micro lot, 1 pip movement is equivalent to $0.1.

Continue reading for more information or start demo trading and notice in real-time how the forex lot size influences your profit and loss. Learn how to master position size in forex trading with our online MasterClass.

01 - Set Your Account Risk Limit per Trade

This is the most important step for determining forex lot size. Set a percentage or dollar risk limit, you'll risk on each trade. Most professional traders risk 1 to 3 percent of their account. For example, if you have a $10,000 trading account, you could risk $100 per trade if you risk 1% of your account on the trade. If your risk 2%, then you can risk $200. You can also use a fixed dollar amount, but ideally, this should be below 2% of your account. For example, you risk $150 per trade. As long as your account balance is above $7,500, then you'll be risking 2% or less. While other variables of trade may change, account risk is kept constant. Choose how much you're willing to risk on every trade, and then stick to it. Don't risk 5% on one trade, 1% on the next, and then 3% on another. If you choose 2% as your account risk limit per trade, then every trade should risk about 2%.

02 - Determine Pip Risk on Trade

You know what your maximum account risk is on each trade, now turn your attention to the trade in front of you.

Pip risk on each trade is determined by the difference between the entry point and where you place your stop loss order. The stop-loss closes out the trade if it loses a certain amount of money. This is how risk on each trade is controlled, to keep it within the account risk limit discussed above.

Each trade varies though, based on volatility or strategy. Sometimes a trade may have five pips of risk, and another trade may have 15 pips of risks. When you make a trade, consider both your entry point and your stop loss location. You want your stop loss as close to your entry point as possible, but not so close that the trade is stopped out before the move you're expecting occurs.

Once you know how far away your entry point is from your stop loss, in pips, you can calculate your ideal forex lot size for that trade.

03 - Determine the Forex Position Size

Ideal forex position size is a simple mathematical formula equal to:

Meaning Of Lots In Forex

- Pips at Risk X Pip Value X Lots traded = $ at Risk

We already know the $ at Risk figure, because this is the maximum we can risk on any trade (step 1). We also know the Pips at Risk (step 2). We also know the Pip Value of each currency pair (or you can look it up).

All that leaves us to figure out is the Lots traded, which is our position size. Assume you have a $5,000 account and risk 2% of your account on each trade. You can risk up to $100, and see a trade in the EUR/USD where you want to buy at 1.3040 and place a stop loss at 1.2990. This results in 50 pips of risk.

If you trade mini lots, then each pip movement is worth $1. Therefore, taking 1 forex mini lot position will result in a risk of $50. But you can risk $100, so you can take a position of 2 mini lots. If you lose 50 pips on a 2 forex mini lot position, you'll have lost $100. This is your exact account risk tolerance; therefore the position size is precisely calibrated to your forex account size and the specifications of the trade. You can plug in any numbers into the formula to get your ideal position size (in lots). The number of lots the formula produces is linked to the pip value inputted into the formula.

source: Forex Trading MasterClass

Final Words

Proper forex position sizing is key. Establish a set percentage you'll risk each trade; 1 to 3 percent is recommended. Then note your pip risk on each trade. Based on account risk and pip risk you can determine your position size in forex lots.

The smaller the forex lot size, the lower the risk because we reduce the following:

- The value of each forex pip.

- The cost of each 1 percent moves against you.

The potential loss if your stop-loss order is hit. We measure risk not by the total position size but by the potential loss if your stop order is hit.

Yes, smaller position sizes mean lower profits when prices move in your favor, with lower interest income from carry-trading. However, the priority is to keep losses low. Always. As a given percent loss requires a larger percent gain to recover your loss because you're trading from a reduced capital base. Once you find the right combination of trading styles, instruments, and technical analysis that suits you, you will have time to increase lot size, risk, and profit potential. Until you're consistently profitable over many months (regardless of your percentage of winning trades), the priority is to keep risk and losses on any given trade to within 1– to 3 percent of your account size. Profiting with only a minority of winning trades is okay, because many profitable traders succeed that way, as discussed in the Forex Trading MasterClass.

Understanding what is 1 forex lot size is important, but if you want some help, MetaTrader 5 AM Broker offers a useful Forex Lot Size Calculator. Start trading and notice how 1 forex lot influence your profit and loss.

Source:

Standard Lot Definition - https://www.investopedia.com/terms/s/standard-lot.asp

Round Turn (Finance) - https://www.nfa.futures.org/faqs/members/nfa-assessment-fees.html

How to Determine Position Size When Forex Trading - https://www.thebalance.com/how-to-determine-proper-position-size-when-forex-trading-1031023

In Forex trading, lot is used to describe the amount a Forex trader is actually trading at any given time – In simpler terms, lot refers to the size of the trade.

To be able to understand what lot is in Forex trading, we need to take a step back in history. A few decades ago, Forex brokers used to offer one contract size only i.e. 100,000 units of currency. Over the years, technological advancements and lower transaction costs made it easier for Forex brokers to offer lower contract sizes hence the birth of smaller lot sizes such as mini lots and micro lots which refer to contract sizes of 10,000 and 1,000 units of currency respectively.

3 Types of Lot Sizes in Forex Trading

There are three main types of lot sizes in the Forex market – The standard lot, mini lot and micro lot. Below is a brief discussion of each of these lot types:

Micro Lot Size in Forex Trading

As the name suggests, a micro lot is equivalent to 1/100th of a standard lot i.e. 1/100 x 100,000 units = 1,000 units of currency or simply, 1,000 units of the base currency which is the 1st currency in any currency pair.

For instance, if you have a currency pair such as the EUR/USD, the base currency is the EUR i.e. the currency you are buying. The other currency (the USD in our case) is the quote currency i.e. the currency you are selling. The price displayed is usually the quote currency. If for instance the EUR/USD is quoted as 1.1400, to buy 1 EUR, you need to pay $1.14.

In our case, you will be trading with 1,000 EUROS if you are trading the EUR/USD with one micro lot. Although it is possible to trade with a smaller lot known as the nano lot which is simply 100 units of the base currency, most Forex brokers allow micro lot trades and above.

Micro lot trades allow new traders to participate in the market without having to start with a lot of capital. A micro lot will also reduce the overall exposure of a new trader allowing them to learn trading with little risk.

When trading with one micro lot, 1 pip movement is equivalent to $0.1.

Mini Lot Size in Forex Trading

A mini lot is equivalent to 1/10 of a standard lot i.e. 1/10 x 100,000 units = 10,000 units of currency.

When trading one mini lot, 1 pip movement is equivalent to $1 – A mini lot is simply 10 times the size of a micro lot.

Although it is possible to trade a mini lot with little capital, it is advisable to have at least $1,000 in your trading account before you attempt to trade a mini lot. If you plan to trade two mini lots simultaneously, you should have at least $2,000 in your trading account and so on.

Standard Lot Size in Forex Trading

As mentioned above, a standard lot is equivalent to 100,000 units of currency. When trading one standard lot, 1 pip movement is equivalent to $10.

You should trade with standard lots when you become a professional trader because standard lots are accompanied by large swings of losses and gains. Before you trade one standard lot, you should have at least $10,000 in your trading account. If you plan to trade two standard lots, you should have at least $20,000 etc.

In conclusion, a lot simply refers to the size of a trade. The standard lot is the biggest lot size while the nano lot is the smallest lot size.

You should trade lots depending on your expertise as well as the size of your capital. Trading with large lot sizes or many lots exposes you to a higher risk-reward ratio.

What Does 1 Lot Size Mean In Forex

If You Want to Become a Successful Forex Trader, You Must Join AndyW Club.